Introduction

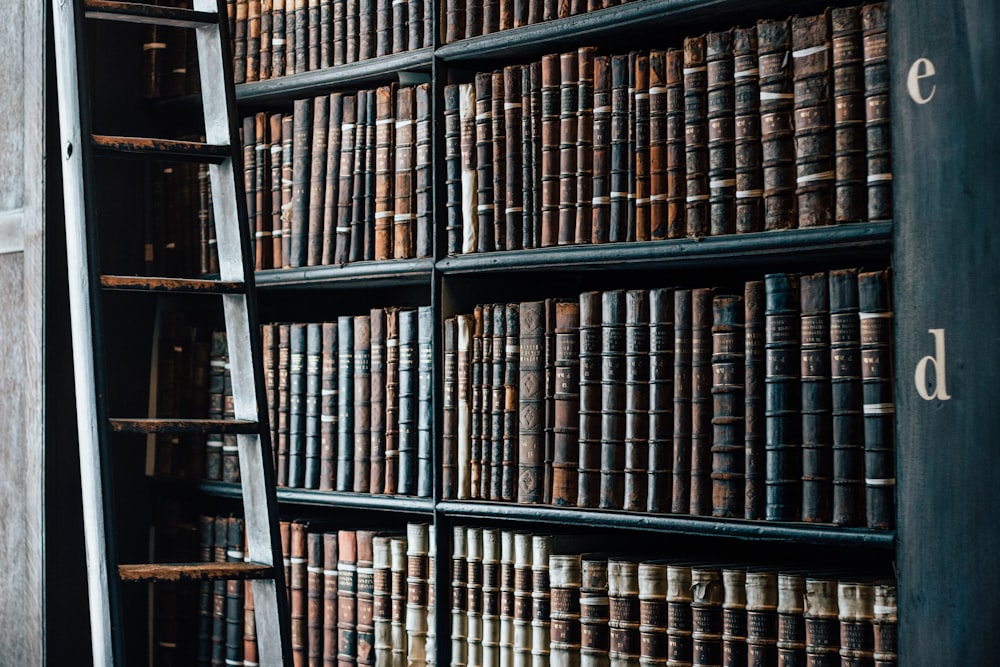

In the world of insurance, navigating the legal landscape can often feel like stepping into a labyrinth of regulations and statutes. At the heart of this intricate framework lies the Insurance Act, a cornerstone piece of legislation that governs the operations of insurance companies and protects the interests of policyholders. Understanding the legal framework provided by the Insurance Act is essential for both industry professionals and consumers alike. In this article, we’ll delve into the nuances of this legislation, breaking down its key components and exploring its implications.

Defining the Insurance Act

First and foremost, it’s crucial to establish what exactly the Insurance Act entails. At its core, this legislation serves as a comprehensive set of rules and regulations that govern the insurance industry. From defining the rights and responsibilities of insurers and policyholders to outlining procedures for claims processing and dispute resolution, the Insurance Act covers a wide range of aspects related to insurance operations. By providing a legal framework for conducting insurance business, the Act aims to promote transparency, fairness, and accountability within the industry.

Key Provisions and Requirements

Within the Insurance Act, there are several key provisions and requirements that shape the landscape of insurance operations. These may include regulations regarding the formation and licensing of insurance companies, the types of policies that can be offered, and the procedures for underwriting and pricing insurance products. Additionally, the Act often establishes guidelines for claims handling, including the obligations of insurers to investigate claims promptly and fairly, as well as the rights of policyholders to appeal claim denials or disputes.

Consumer Protections and Rights

One of the primary objectives of the Insurance Act is to safeguard the interests of consumers and policyholders. To achieve this, the Act typically includes provisions that outline the rights and protections afforded to individuals purchasing insurance policies. These may encompass requirements for clear and transparent policy documentation, disclosure of terms and conditions, and mechanisms for resolving disputes or grievances. By ensuring that consumers are adequately informed and protected, the Act aims to foster trust and confidence in the insurance industry.

Compliance and Enforcement

Ensuring compliance with the provisions of the Insurance Act is essential for maintaining the integrity and stability of the insurance market. To this end, regulatory authorities are often tasked with overseeing and enforcing adherence to the Act’s requirements. This may involve conducting audits and inspections of insurance companies, investigating complaints or allegations of misconduct, and imposing penalties or sanctions for non-compliance. By holding insurers accountable for their actions and decisions, regulatory enforcement helps uphold the principles of fairness and accountability embedded in the Act.

Implications for Industry Professionals

For professionals working within the insurance industry, a thorough understanding of the Insurance Act is indispensable. From underwriters and claims adjusters to brokers and agents, individuals involved in insurance operations must be familiar with the legal framework established by the Act and ensure compliance with its provisions. This may involve ongoing training and education, as well as staying abreast of any updates or changes to the legislation. By adhering to the requirements of the Act, industry professionals can uphold ethical standards and best practices, thereby promoting trust and confidence among consumers.

Conclusion Read more about insurance act